Blog

January 23, 2025

How the Cable Industry has Transformed in the DOCSIS 4.0 Era

By Joe McGarvey, Marketing Director |

Six years ago this month, CableLabs® announced the release of DOCSIS 4.0, the next generation of the venerable data-over-cable specification that has played an instrumental role in making MSOs dominant broadband providers in North America, as well as other parts of the world. Though commercial deployments based on the specification are only now beginning to go live, the impact of DOCSIS 4.0 and subsequent technology introductions, it can be argued, have significantly altered the nature and future direction of the cable industry.

DOCSIS 4.0’s biggest distinction from previous versions — that it offers two approaches to utilizing additional spectrum — unofficially serves as the beginning of the MSO community’s divergence from a common technology roadmap. Up until the specification’s introduction, nearly every MSO followed a similar, if not identical, technology architecture and HFC evolution track, which has been replaced by an increasing number of technology and architecture choices.

Network architects and engineers now toil daily to devise an HFC evolution strategy, taking into consideration multiple options, including the reallocating of spectrum, when or if to upgrade to the next level of DOCSIS, best practices for migrating to a distributed access architecture or if it makes sense to accelerate their HFC transitions to PON — to name just a few.

Breaking from Tradition

Events at the most recent SCTE TechExpo were emblematic of the shifting cable industry landscape. Without acknowledging the irony, major industry players opened access to a unified version of DOCSIS 4.0, which integrates both FDD and FDX approaches to spectrum allocation into the same silicon, after essentially shutting out much of the industry a year earlier with a Joint Development Agreement that limited access to unified silicon to only the JDA partners.

Within hours of that revelation, the same industry forces unveiled they were working to extend the DOCSIS roadmap further, introducing DOCSIS 5.0, which promises downstream bandwidth speeds of 25Gbps. That the technology enhancement plans were revealed by select members of the cable community — rather than standards bodies — was a break from tradition, according to industry sources, who also suggested that the sense of cohesiveness that once defined the cable industry was beginning to unravel.

And if all those broadband-related technology choices weren’t enough to keep cable executives up at night, additional sleep is being lost over two other monumental decision points: the best approach to converging mobile voice with broadband and how best to deal with the continued hemorrhaging of video subscribers.

Multiple Crossroads

In addition to MSOs encountering multiple technology crossroads over the past several years, they have also seen significant changes in the competitive landscape. While streaming services continue to induce cord cutting, telcos have made significant strides in replacing aging and outdated DSL services with FTTH offerings, posing new speed and operational efficiency challenges to HFC networks. On the low end of the residential broadband market, FWA providers of late have significantly increased subscriber share, largely at the expense of MSOs.

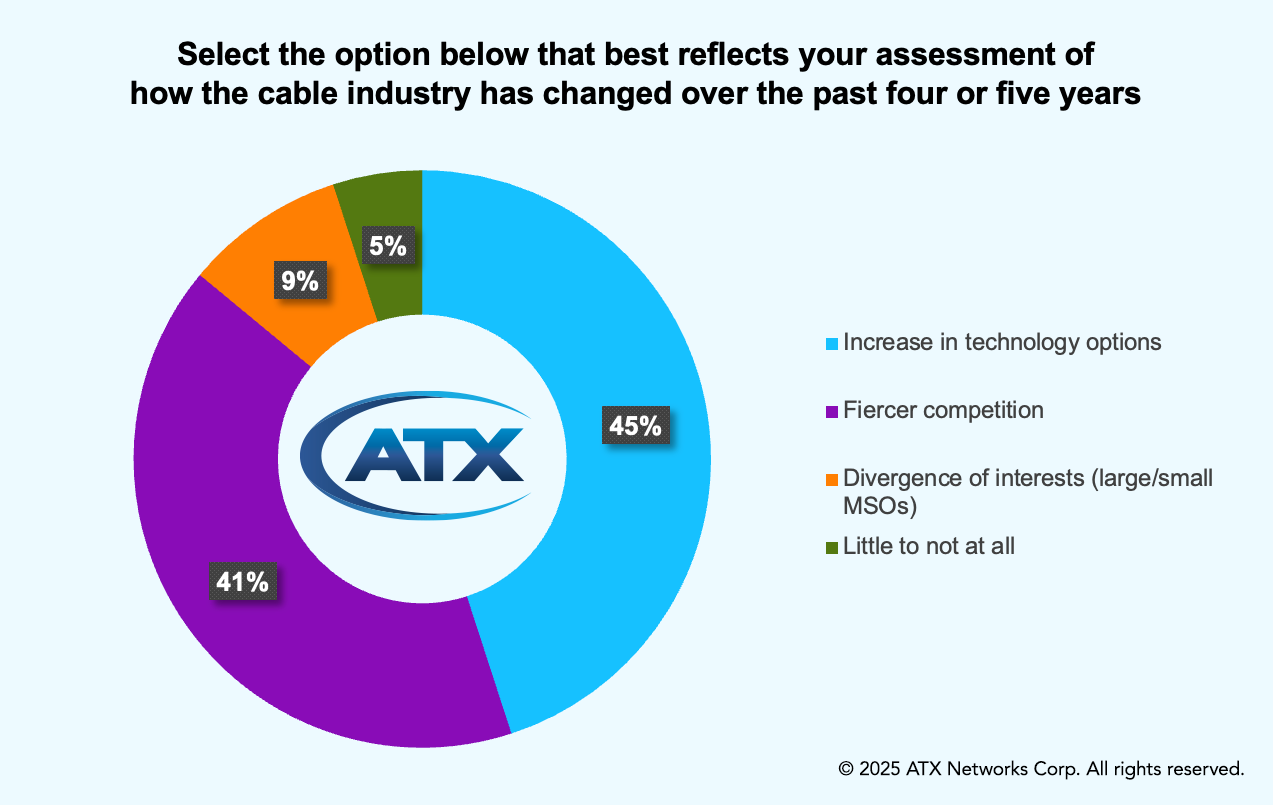

Given all this change and the shifting nature of the cable industry, ATX is focusing its upcoming annual HFC evolution survey, our fifth, on how the attitudes and mindsets of industry professionals have changed in the DOCSIS 4.0 era. This year’s 2050 Project Survey is designed to not only provide insight into MSOs’ current network evolution plans, but to also deliver datapoints that help to quantify how much the industry has changed since the introduction of DOCSIS 4.0 in 2019.

Preliminary findings from this year’s survey appear to validate the perception that MSOs are no longer in lockstep when it comes to the evolution of their networks. The top response to the above question was an Increase in technology options, with nearly half (45%) of participating cable professionals selecting that option. The second highest response (41%) reflects survey takers’ perception of an uptick in the level and nature of broadband competition. Only 5% of the survey universe believe the current cable industry landscape has changed little, if at all, over the past five years.

In many ways, the 2050 Project Survey is itself a product of the shifting nature of the cable industry. The emergence of multiple technology options back in 2020 prompted ATX to develop primary research that would assist MSOs in tracking the network evolution plans of their peers, creating a weathervane of sorts to offer annual guidance on which way the winds of technology change were blowing.

Considering all the gusts of innovation and technology introductions that have swept through the industry in recent years, this year’s HFC evolution survey may be the most relevant yet.

The 2050 Project Survey complete findings and analysis will be available in the first quarter of this year. Previous versions of the survey results, as well as other collateral related to the 2050 Project, can be found here.