Blog

May 7, 2024

MSOs must Execute Next-Phase of HFC Evolution with Timing and Precision to Maintain Broadband Leadership

By Joe McGarvey, Marketing Director |

Whether the final destination is DOCSIS® 4.0 or optimizing DOCSIS 3.1 for all its worth, MSOs need to continue to evolve their networks to keep pace with subscriber demand and fend off competitors, including FTTH providers offering multigigabit symmetrical services.

But MSOs can’t afford to focus on speed and capacity gains alone. A major attribute of DOCSIS 4.0 is that it will eventually require MSOs to upgrade nearly all the actives and passives in their outside plants. That sort of node-to-tap renovation project, though large in scope, provides MSOs with a once-in-a-generation opportunity to completely revitalize their networks, as well as the broadband services they deliver.

Done the right way the next phase of the HFC evolution will result in a cable access plant that is considerably faster, more reliable, more responsive, more intelligent and more open than ever before. That’s the opportunity offered by the adoption of the FDD version of DOCSIS 4.0, which comes with both business-as-usual and revolutionary implications for MSOs.

Same Ole, Same Ole

On the BAU side, a DOCSIS 4.0-driven evolution of the HFC network is a sort of déjà vu, the sense that engineers and network designers have been here, done that, many times before. That feeling of familiarity is likely due to the extraordinary efforts that technologists and equipment makers have applied to reducing the expense and disruption of moving to 1.8GHz by largely enabling MSOs to expand the capability of existing equipment through drop-in upgrades.

In most instances, MSOs will be able to update the nodes and amplifiers in their networks through component, or module, upgrades, allowing them to reuse existing enclosures. In cases where new equipment is required or preferred, it can often be installed in the same location, enabling MSOs to avoid costly respacing exercises, which sometimes require lengthy permitting procedures and added expenses associated with new construction. Taps and passives, the most plentiful devices in the outside plant, can also be replaced by 1.8GHz-capable equipment without requiring MSOs to redesign the last mile of their networks.

By reducing the cost and complexity of moving to 1.8GHz, technology suppliers have helped MSOs gain a huge financial advantage over competitors building out new all-fiber networks. While industry experts and several major MSOs have estimated the per-home-passed cost of upgrading their networks from $100 to $250, FTTH network builders are expected to pay roughly 10 times that amount, according to several public sources.

Upgrade vs Overbuild

Building out fiber networks, largely from scratch, also takes much longer than upgrading an existing HFC plant, given the difficulties of navigating red-tape-entangled permitting requirements and other drags on productivity. These financial and timing advantages, along with speed and capacity gains that will satisfy subscriber demand for decades, have restored confidence that MSOs will acquire the punching power to fend off competitive threats from FTTH challengers well into the future.

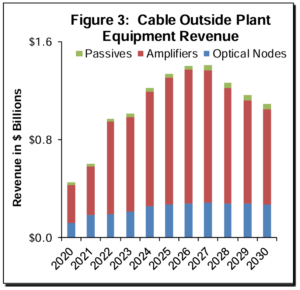

Cable operators are also demonstrating enthusiasm for upgrading their networks with their wallets. MSOs are expected to shell out for infrastructure upgrades at levels not seen for decades. Look for spend on equipment to upgrade the outside plant to more than double from 2020, reaching peaks over the next few years, according to a report published by Dell’Oro Group in May 2023.

MSOs, as cited earlier, enjoy significant cost and time-to-market advantages over FTTH competitors. While telecommunications providers have no other choice than to build out new networks from scratch due to their copper-based DSL networks running out of capacity, MSOs are in the enviable position of owning a legacy coaxial-based network that reaches into thousands of neighborhoods and is capable of supporting multigigabit symmetrical services, or rates as high as 50Gbps, according to this analysis.

But just because MSOs hold an upgrade-instead-of-overbuild advantage over FTTH providers doesn’t mean they can let their guards down.

But just because MSOs hold an upgrade-instead-of-overbuild advantage over FTTH providers doesn’t mean they can let their guards down. FTTH providers, some of the largest corporations in the world, are well financed and likely to benefit disproportionately in comparison to MSOs in the distribution of billons of public funds being dedicated to the buildout of broadband networks to rural and other underserved areas.

Perception Problem

Service providers offering all fiber connections to homes and businesses also enjoy a “perception” advantage over cable operators, as many consumers now view MSOs as “outdated” or “legacy” providers. These conditions have significantly reduced the margin of error for cable operators optimizing their DOCSIS 3.1 architectures or upgrading their HFC infrastructures to DOCSIS 4.0. MSOs that are slow to evolve their networks, or make missteps along the way, could become vulnerable to challenges from both FTTH and Fixed Wireless Access (FWA) providers.

To assist MSOs in executing their DOCSIS 3.1 or DOCSIS 4.0 upgrades with precision and timeliness, ATX developed a comprehensive guide that presents a broad swath of options and upgrade scenarios that MSOs should consider as they reconstruct their cable access plants from the headend to the cable modem, with particular focus on the components of the outside plant. The Definitive Guide to Evolving Your HFC Network also touches on other network upgrade issues that will impact the speed and quality of their network overhauls, including a shortage of qualified technicians.

MSOs have a path to maintaining their current dominance in the broadband services arena. But getting to the broadband Promised Land before competitors hinges on the flawless and timely upgrade of their current HFC networks, and making the most of this once-in-a-generation upgrade of their outside plants.