Blog

April 12, 2024

Survey Says: MSOs Enter 2024 Weighing Network Upgrade Options

By Joe McGarvey, Marketing Director |

The results of the 2024 Edition of ATX’s annual HFC evolution survey, conducted at the beginning of this year, indicate that some MSOs, faced with an unprecedented flurry of technology options, may be recalculating the tactics and timeline for upgrading their networks.

That conclusion can be drawn from soon to be published findings from the fourth and most recent edition of the 2050 Project Survey, which can be downloaded here. The survey report includes the analysis of responses to more than 25 questions meant to uncover MSOs’ plans for the long-term evolution of their networks.

If a theme could be gleaned from this year’s results, it is that the sheer number of technical options now confronting MSOs — including which flavor of DOCSIS 4.0 to adopt, new extensions to DOCSIS 3.1, upstream spectrum allocations and those related to moving to a distributed access architecture — may be contributing to deployment hesitation, or, at the very least, increased pressure on the executives and technology wizards responsible for evolving the HFC network.

Dealing with these complexities, as well as an increase in competitive attacks from both wireless and fiber providers, may have contributed to instances of survey findings indicating that MSOs may be reevaluating deployment decisions or directions that appeared to have been locked in just a year ago.

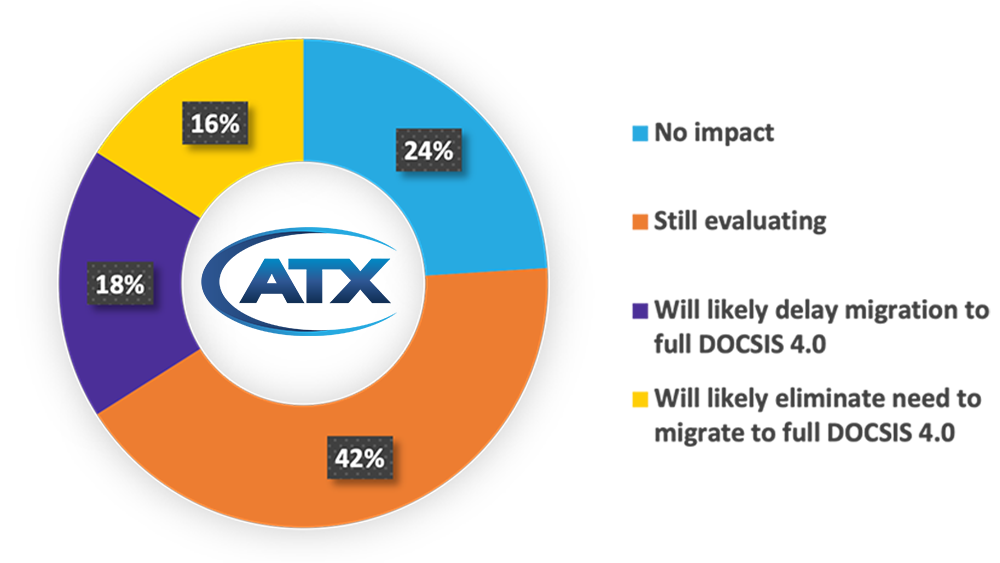

The recent introduction of technology that enables MSOs to extend the capacity of DOCSIS 3.1 architectures, for example, prompted more than 40% of survey takers to answer Still evaluating to a question about the impact of the new technology, commonly referred to as DOCSIS 3.1 Extended, or DOCSIS 3.1E, for short.

What impact will the availability of DOCSIS 3.1E have on your DOCSIS 4.0 adoption plans?

While 24% of respondents indicated that DOCSIS 3.1E will not impact or alter their current plans, 18% and 16% of survey takers, respectively, said that the technology would likely delay or eliminate a migration to full-blown DOCSIS 4.0.

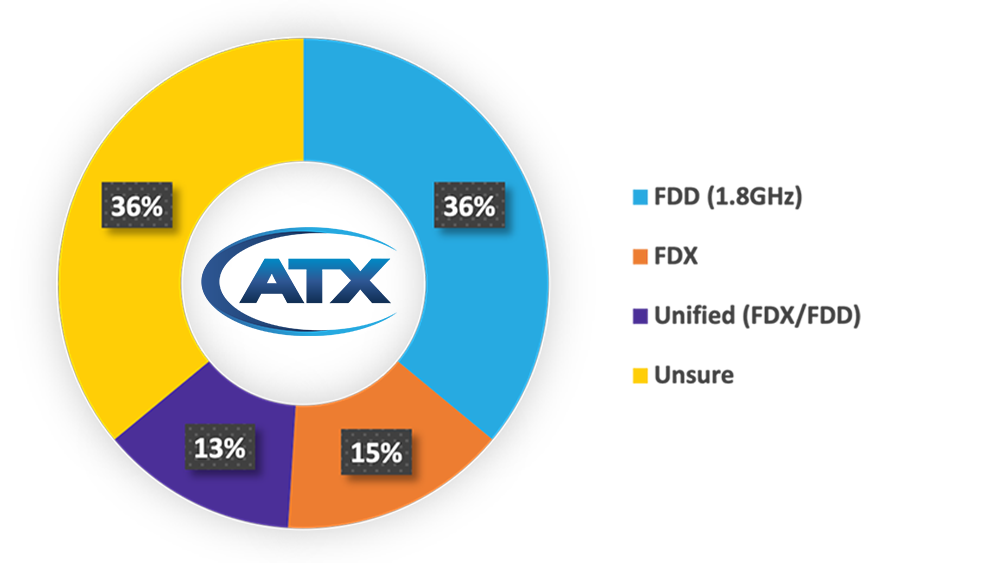

Similarly, the inclusion in the survey of a Unified version of DOCSIS 4.0, which supports both FDD and FDX flavors of the specifications, appears to have injected new uncertainty around how best to integrate DOCSIS 4.0 into the HFC network. Almost 40% of respondents now indicate they are Unsure about their preferred flavor of DOCSIS 4.0.

Which version of DOCSIS 4.0 are you more likely to adopt?

Just a year ago, only 25% of respondents answered Unsure to the same question. That’s an 11% bump in MSO uncertainly from 2023 to 2024.

The 2024 edition of the survey includes the opinions of 146 cable industry professionals, a figure that exceeds previous survey participation by roughly 50%. Most respondents work for companies based in North America, but the findings also include responses from participants in the EMEA and CALA regions. ATX also asked respondents to identify the number of subscribers in their service areas.

A challenging economic environment, in addition to the unprecedented number of technology options, appears to have also contributed to slowdowns among MSOs in the pace of their network evolutions in 2023. Overall, though, findings from this year’s survey indicate that even though MSOs may be evaluating or recalculating the nature and pace of their network upgrades, most remain dedicated to evolving their HFC networks to support multigigabit symmetrical services.

MSOs have been the leading providers of reliable, robust and affordable broadband services for the past several decades. Maintaining that dominance in the future will require MSOs to continue to expand the speed and capacity of their networks, but to also focus on improving subscriber experience. Results of the 2024 edition of the 2050 Project Survey suggest that MSOs are wisely focusing on utilizing intelligence recently built into outside plant equipment, namely amplifiers and nodes, to increase network reliability and reduce the time it takes to troubleshoot and mitigate disruptions.

MSOs are also increasingly concerned about the impact of their operations on the health of the planet, according to report findings. Upgrading their networks by reusing much of the existing infrastructure, rather than building out new networks, and by moving to a cleaner source of energy storage, puts MSOs on an eco-friendly evolutionary path.

Another major survey takeaway is that the focus on customer experience, reliability and sustainability revealed by survey findings indicate that MSOs, despite a few roadblocks, appear to be headed into the second half of the year fully committed to maintaining their broadband leadership.

ATX will preview the findings from the 2024 edition of the survey, as well as provide expert analysis from CTO and outside plant expert Jay Lee in a webinar airing on April 25th at 11 EDT.